Asking (most) Board Advisors if they would like to advise a tech start-up is like asking a car enthusiast if they would like to own James Bond’s Aston Martin DB5. The answer can only ever be “Yes!”

In previous decades, making the connection was much easier, whereas nowadays, start-ups have an eye-watering number of resources at their disposal, when it comes to support for growing their business.

You only need to visit any major city and note the high number of tech incubators/accelerators. These “accelerators” offer to support entrepreneurial ambition and in many instances, they go on to take these ambitious start-ups to the “next level”. But be warned, this is not a free ride and the accelerator will often take a huge chunk of the company’s equity in this trade of skills and know-how.

But what if there was another route available to these start-ups? What if the start-up founder(s) could build this value themselves without huge investment up front! I am, of course, talking about the “Advisory Board”.

Advisory Board members can often act as mentors to the founder and their team as they build their business. This approach is something I have seen first-hand in multiple companies of my own and in those where I sit as a non-executive director.

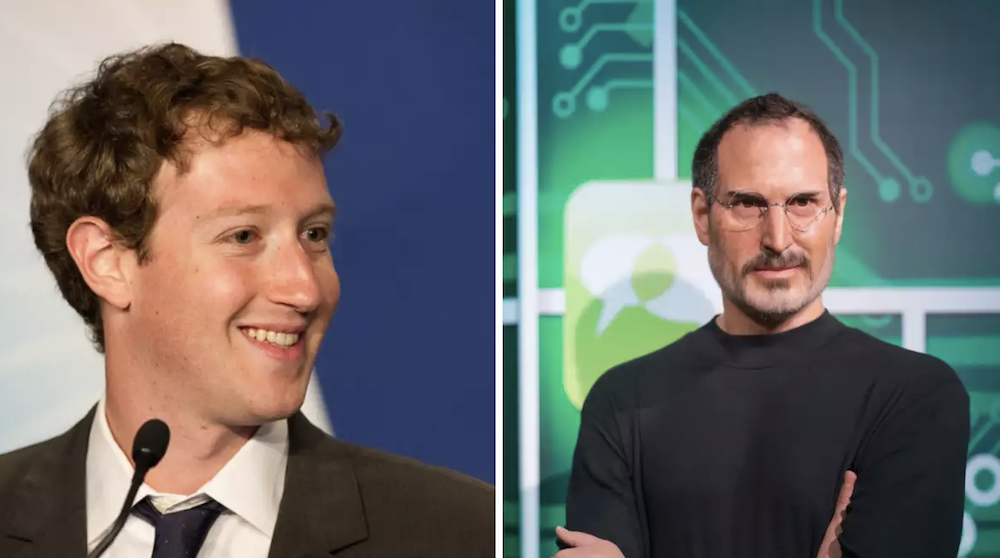

With some big names in the tech world quoting the help and guidance they received being a major contributor in their success (Mark Zuckerberg often cites Steve Jobs' mentorship as critical to the social media platform's success, as just one example), there must be something in this.

Endeavor Insight reported that 33 percent of New York based tech entrepreneurs who were mentored by other top entrepreneurs went on to run their own successful companies. As a comparison, the alternative (ie. entrepreneurs with no mentor/advisor) was a much, much lower number!

Whereas a Board consists of shareholder members who have the authority to make key decisions, an advisory board is not a formal entity. In fact, they don’t work for the company. But don’t read this as a negative as an advisory board can be central to helping you build your business, attract investment and indeed, be successful.

THERE’S NO SUCH THING AS ‘EXACT SCIENCE!”

There is no downloadable template “Free for 30 days” for putting together an advisory board. Choosing the wrong people to advise your company can have some major impactful effects, too. But if you take a level headed approach to this task, building a list of potential candidates, the process does not need to be painful. It is important to keep these principles in mind:

1. Size of your Board: Be selective. Don’t accept all the advice you receive as much of it may not be applicable. The great nuggets will appear and you will (in most cases) know which ones are going to work. An advisory board of four (or fewer) members who have the skills and experience you want should be plenty.

2. Compensation: Before making an approach to the potential advisory board members, determine how much you are willing to give away in equity. Advisors typically receive anywhere from 0.25 percent to 2 percent equity. For the perfect advisor, always consider a higher number.

A great piece of advice is "Never hire anyone as an advisor if they want to be hired as advisors". The best ones, and the only ones that perform, tend to be those who just want to help. If you see value, then employ them in the role, officially.

3. Meeting Frequency: When discussing the time you expect an advisory board member to invest, make absolutely clear that this is not a full or part time role. The time commitment should be nowhere near weekly or even monthly and can often be as infrequent as quarterly meetings. You may also want to pitch these meetings as great opportunities for potential advisors to work with other influential members of your board.

If you are not sure if you are ready for your own advisory board, consider joining another. It’s a sure-fire way to make great connections and apply your own expertise to a company's growth.

If you have peers with expertise in your company's less strong areas, consider asking them to help you in your search. Be sure to tap into your personal network and seek referrals when possible.

Peer-2-peer is a massive value add in this scenario. It's what Virtualnonexecs.com was born to do.