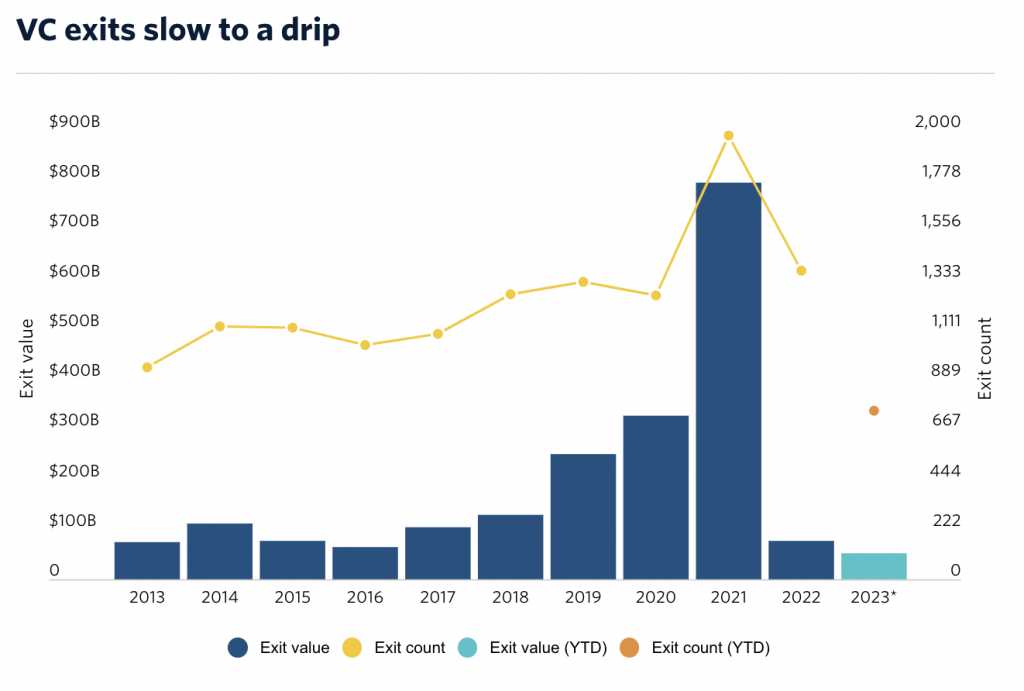

In the grand theatre of venture capitalism, nothing says “high hopes and shattered dreams” quite like an IPO. 2023, for instance, showcased this epic drama as VCs clutched onto the glimmers of hope that IPOs like Klaviyo and Instacart brought, only to watch them fizzle out like a wet firework on Bonfire Night.

A Glimmer in the Gloom: The IPO Facade

Oh, Q3, you tantalising tease!

With the strongest VC exit values since the memorable Q4 of 2021, it felt like the stars were finally aligning. A round of applause for Klaviyo and Instacart, which, like Cinderella at the ball, momentarily danced above their expected values. However, much like a pantomime plot twist, they found themselves trading below their IPO values faster than you can say, “He’s behind you!”

The IPO Illusion: A Never-ending Carousel

It’s a well-documented fact: VCs have an insatiable appetite for IPOs. Between 2019 and 2021, a staggering 70% of all liquidity came from IPOs, making it the champagne of VC exit strategies. However, it seems 2023’s menu only offers cheap sparkling wine, and speaking to many in the VC space, it seems the hangover is real!

To List or Not to List: That’s the (Dollar) Question

As the curtains prepare to close on 2023, the backstage whispers grow louder: no major listings in sight. The once-shimmering hope of an IPO-driven rebound has dimmed to a flicker. According to analyst, Kyle Stanford, we shouldn’t hold our breath for a grand entrance of VC-backed companies onto the stage in early 2024 either.

And in a twist reminiscent of a Shakespearean tragedy (I’m reminded of Shakespeare as I write this piece from a hotel lobby in the city of Verona!), some VCs, ever the cautious parents, are advising their prodigious late-stage firms to postpone their grand debuts. Best to wait, they say, till the fickle mistress of public interest stabilises. And who knows? Maybe, just maybe, public markets might start splashing out on growth stocks.

A venture capitalist can dream, can’t they?

A Word on M&As: Well, They Tried…

Shifting our gaze from the tragicomedy of IPOs, let’s spare a thought for the M&As and buyouts. It seems they too have caught the gloomy bug of 2023. Predicted to hit rock bottom by year-end, one might say they’re in a “bit of a pickle.”

Concluding Our Darkly Tale of Woe…

In the rollercoaster world of venture capitalism, 2023 feels like that one ride which gets your hopes up with a steep climb, only to drop you down without warning. Still, there’s still the optimists out there, who keep lining up for another go.

After all, there’s nothing quite like the dizzying highs (and lows) of a good old IPO dream.

Cheers!