The integration of seasoned M&A professionals as non-executive directors on boards is not just beneficial; it is essential for navigating the complexities and unlocking the potential of M&A. Detailed insights from PitchBook’s Q3 2023 US VC Valuations Report highlight the tangible benefits and strategic advantages of incorporating M&A expertise at the board level.

1. Strategic Decision-Making Enhanced by Market Insights

The report indicates a robust M&A environment, with median valuations in M&A deals seeing an uptick, suggesting a growing preference for well-established, high-performing companies. M&A experts can provide invaluable insights into these market dynamics, helping boards to identify strategic acquisition targets and optimal timing for transactions, thereby maximizing investment returns.

2. Risk Assessment and Due Diligence

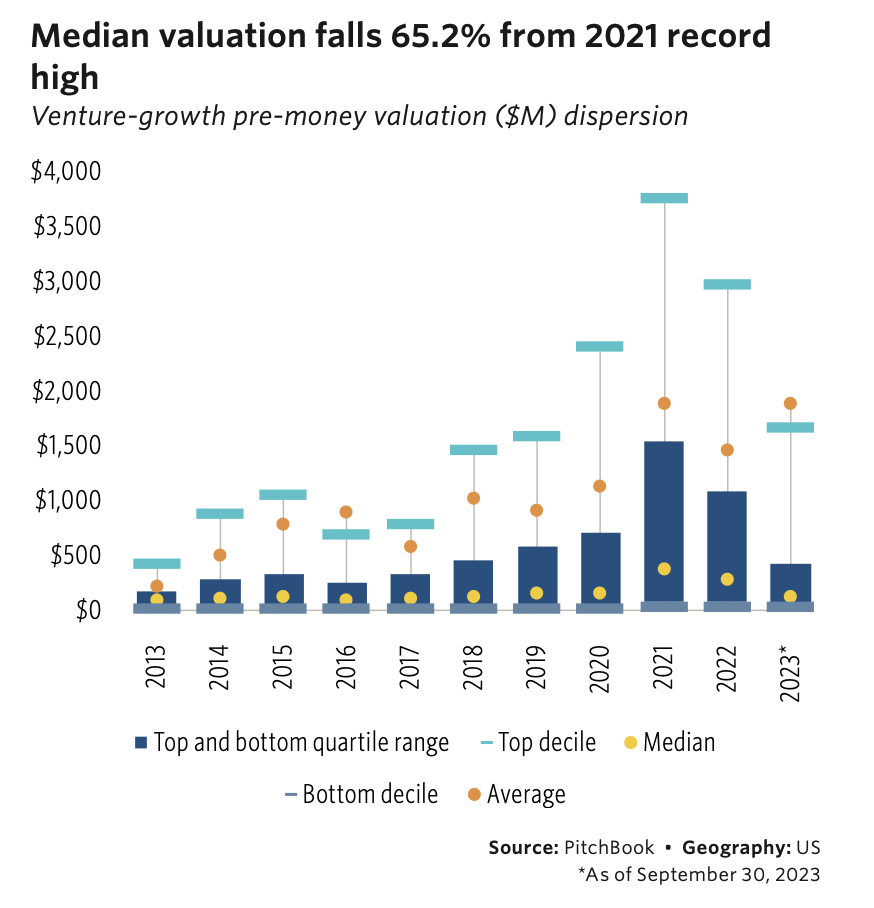

M&A transactions are fraught with complexities and potential pitfalls. According to PitchBook, the venture-growth stage companies face significant valuation compressions, a drop of 65.2% from their 2021 highs. An experienced M&A NED can lead rigorous due diligence efforts, evaluating risks and compliance issues to safeguard the company against value-destructive acquisitions.

3. Negotiation and Deal Structuring

With their deep understanding of deal mechanics and market conditions, M&A expert NEDs bring critical negotiation leverage. For instance, late-stage VC deals have witnessed a median pre-money valuation rise to $63.0 million in Q3 2023 from previous quarters, underscoring the importance of skilled negotiation to capitalize on valuation trends.

4. Governance and Oversight

M&A-focused NEDs ensure that all transactions adhere to legal and regulatory frameworks, aligning with best practices in corporate governance. This oversight is crucial, especially when navigating the complex regulatory landscapes that impact deal structures and execution.

5. Stakeholder Engagement and Communication

Effective communication with stakeholders is crucial, particularly in times of significant organizational change. M&A experts can articulate the strategic rationale behind acquisitions, fostering transparency and maintaining trust among shareholders, a practice underscored by the growing complexities and scale of transactions reported by PitchBook.

6. Objective and Unbiased Perspectives

M&A transactions can be influenced by various internal and external pressures. NEDs with M&A expertise offer objective oversight, making unbiased decisions that prioritize long-term shareholder value over short-term gains.

The strategic integration of M&A expertise in the form of non-executive directors is more than a best practice – it is a strategic necessity in today’s competitive market environment. The data and trends reported by PitchBook in their latest analysis not only underscore the current dynamics of the M&A landscape but also highlight the critical role that seasoned experts play in guiding companies through successful mergers and acquisitions.

As firms navigate these strategic waters, the value of experienced M&A professionals on their boards cannot be overstated, ensuring that each decision is aligned with broader corporate objectives and market realities.